Maryland Tax Calculator

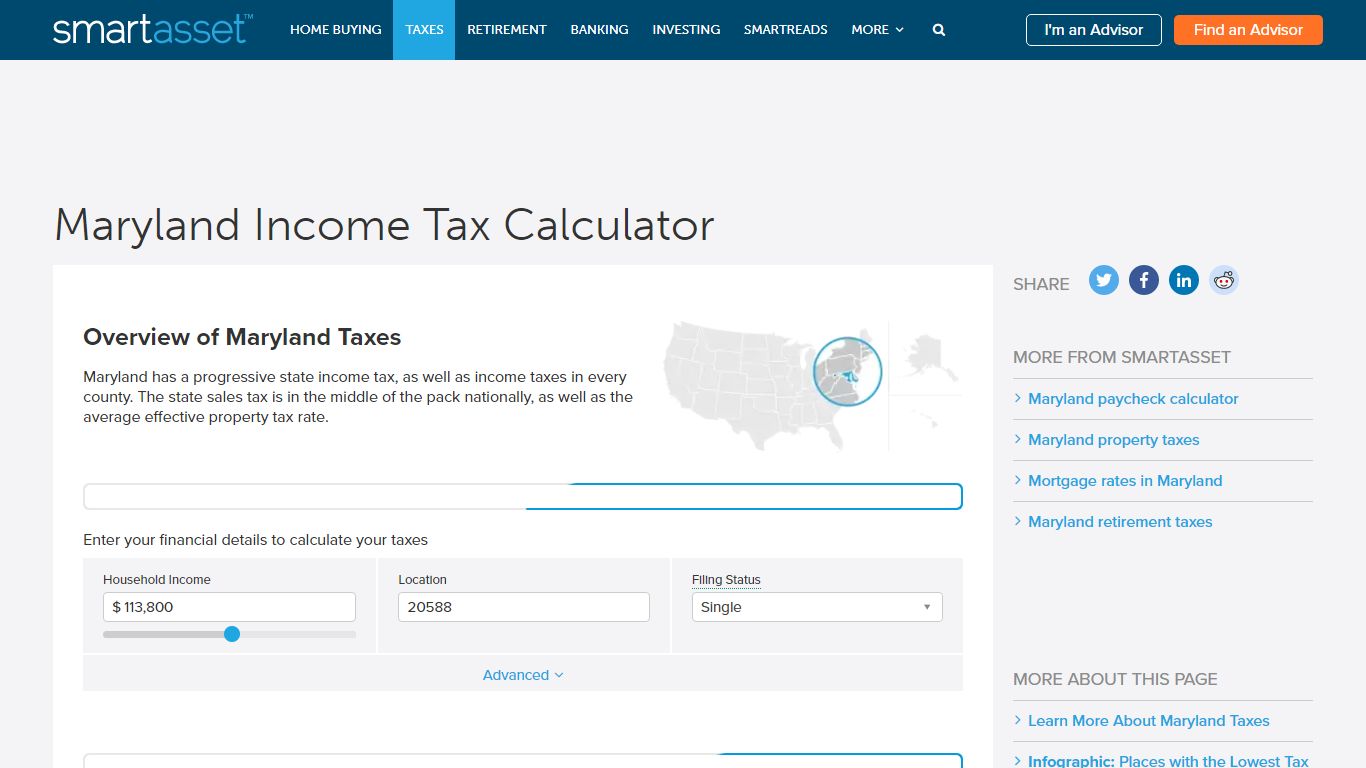

Maryland Income Tax Calculator - SmartAsset

The above rates apply to Maryland taxable income.Maryland taxable income is based on your federal adjusted gross income (AGI), but with some differences. While the number of personal exemptions in Maryland will equal the number of exemptions on your federal tax return, the exemption amount is different.. For single filers with an income less than $100,000, or joint filers with an income of ...

https://smartasset.com/taxes/maryland-tax-calculator

Tax Calculators - Marylandtaxes.gov

If you have any questions, please contact our Collection Section at 410-260-7966. Estimated Payment Calculators. Quarterly Estimated Tax Calculator - Tax Year 2022. Use this calculator to determine the amount of estimated tax due for 2022. Quarterly Estimated Tax Calculator - Tax Year 2021.

https://www.marylandtaxes.gov/online-services/tax-calculators.php

Tax Calculators - Marylandtaxes.gov

If you have any questions, please contact our Collection Section at 410-260-7966. Estimated Payment Calculators. Quarterly Estimated Tax Calculator - Tax Year 2022. Use this calculator to determine the amount of estimated tax due for 2022. Quarterly Estimated Tax Calculator - Tax Year 2021.

https://interactive.marylandtaxes.gov/online-services/tax-calculators.php

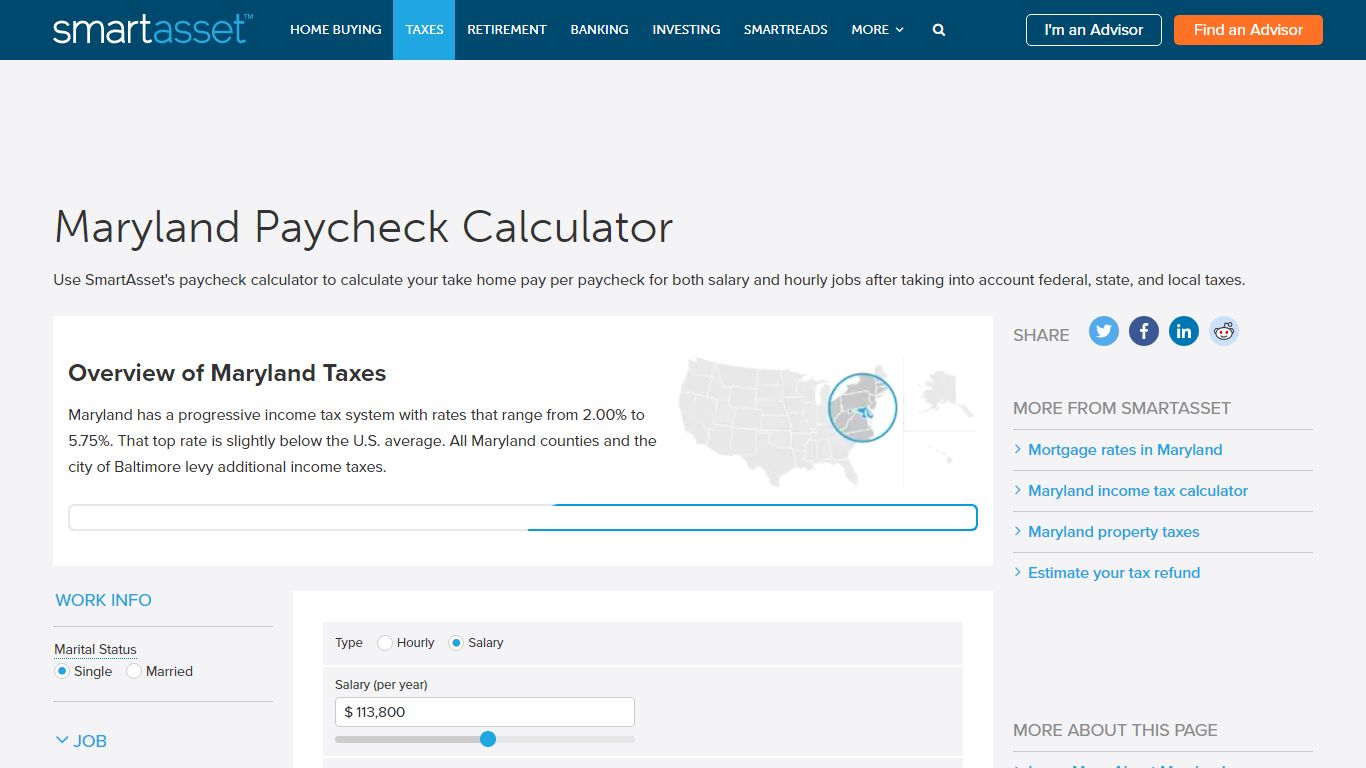

Maryland Paycheck Calculator - SmartAsset

You can pay the relevant taxes on your Maryland state income tax return, as there is no separate tax form for county or city income taxes. Local rates range from 2.25% to 3.20%. The local tax rate you’ll pay in Maryland is based on where you live, not where you work.

https://smartasset.com/taxes/maryland-paycheck-calculator

Maryland Tax Calculator: Estimate Your Taxes - Forbes Advisor

Maryland Income Tax Calculator 2021. If you make $70,000 a year living in the region of Maryland, USA, you will be taxed $11,612. Your average tax rate is 11.98% and your marginal tax rate is 22% ...

https://www.forbes.com/advisor/income-tax-calculator/maryland/Business Tax Calculators - Marylandtaxes.gov

If you have any questions, please contact our Collection Section at 410-260-7966. Use this calculator to determine the amount of estimated tax due for 2022. Use this calculator to determine the amount of estimated tax due for 2021. Use this calculator to determine the amount of estimated tax due for 2020.

https://www.marylandtaxes.gov/business/online-services/tax-calculators.php

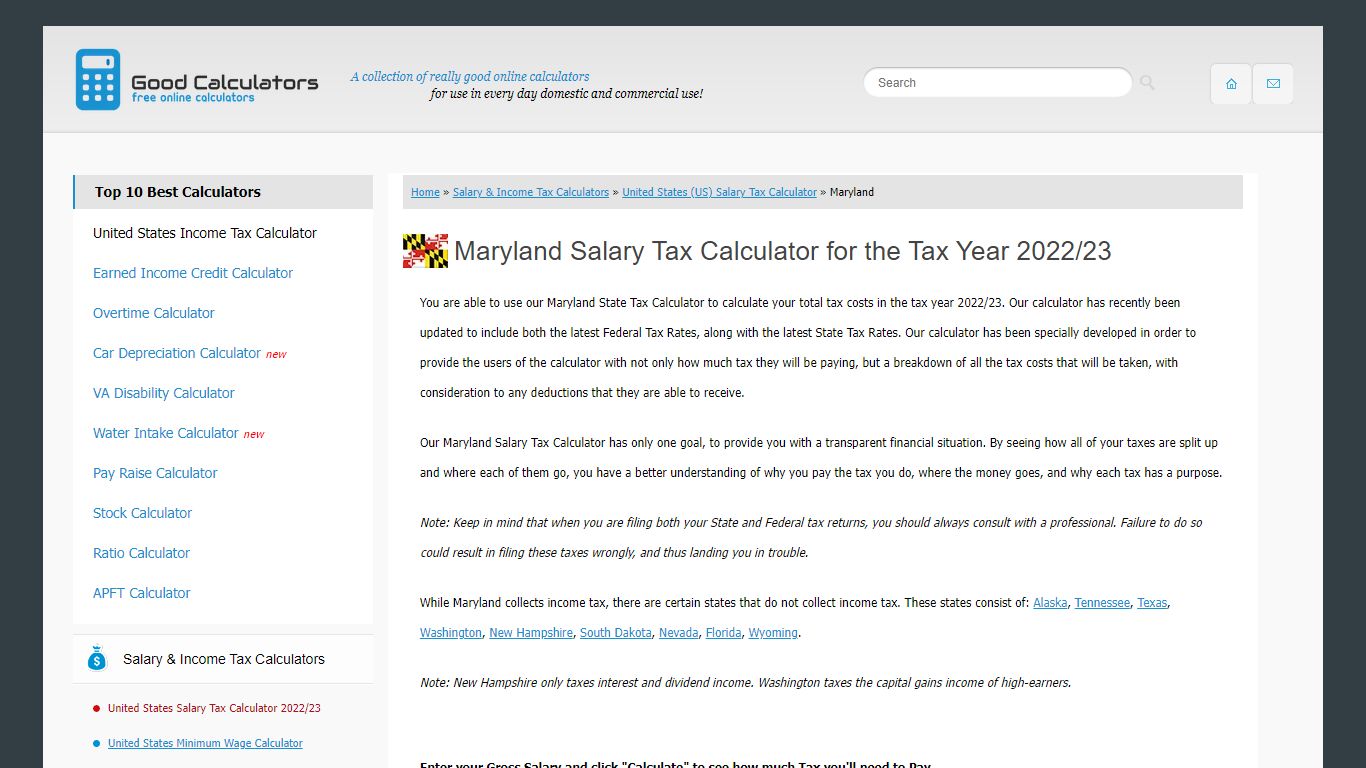

Maryland State Tax Calculator - Good Calculators

To use our Maryland Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

https://goodcalculators.com/us-salary-tax-calculator/maryland/

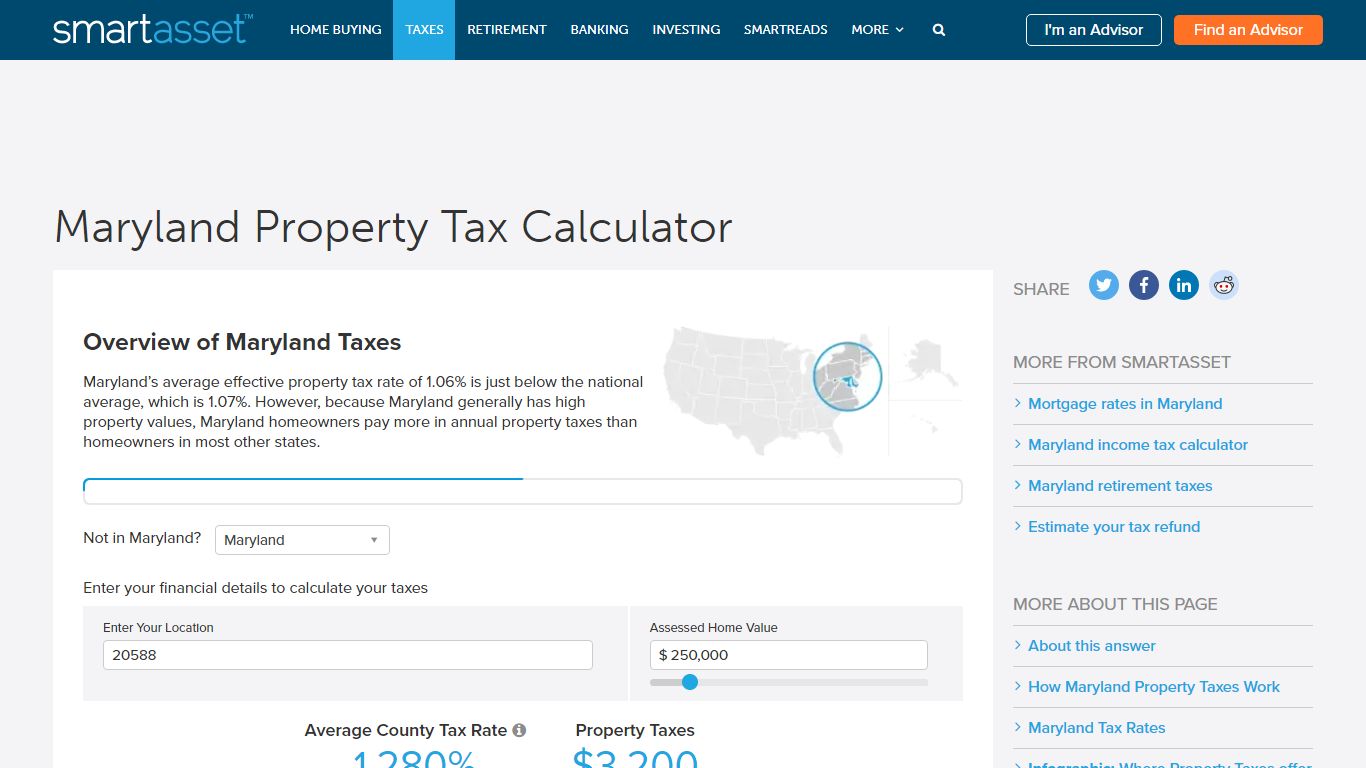

Maryland Property Tax Calculator - SmartAsset

Overview of Maryland Taxes. Maryland’s average effective property tax rate of 1.06% is just below the national average, which is 1.07%. However, because Maryland generally has high property values, Maryland homeowners pay more in annual property taxes than homeowners in most other states.

https://smartasset.com/taxes/maryland-property-tax-calculator

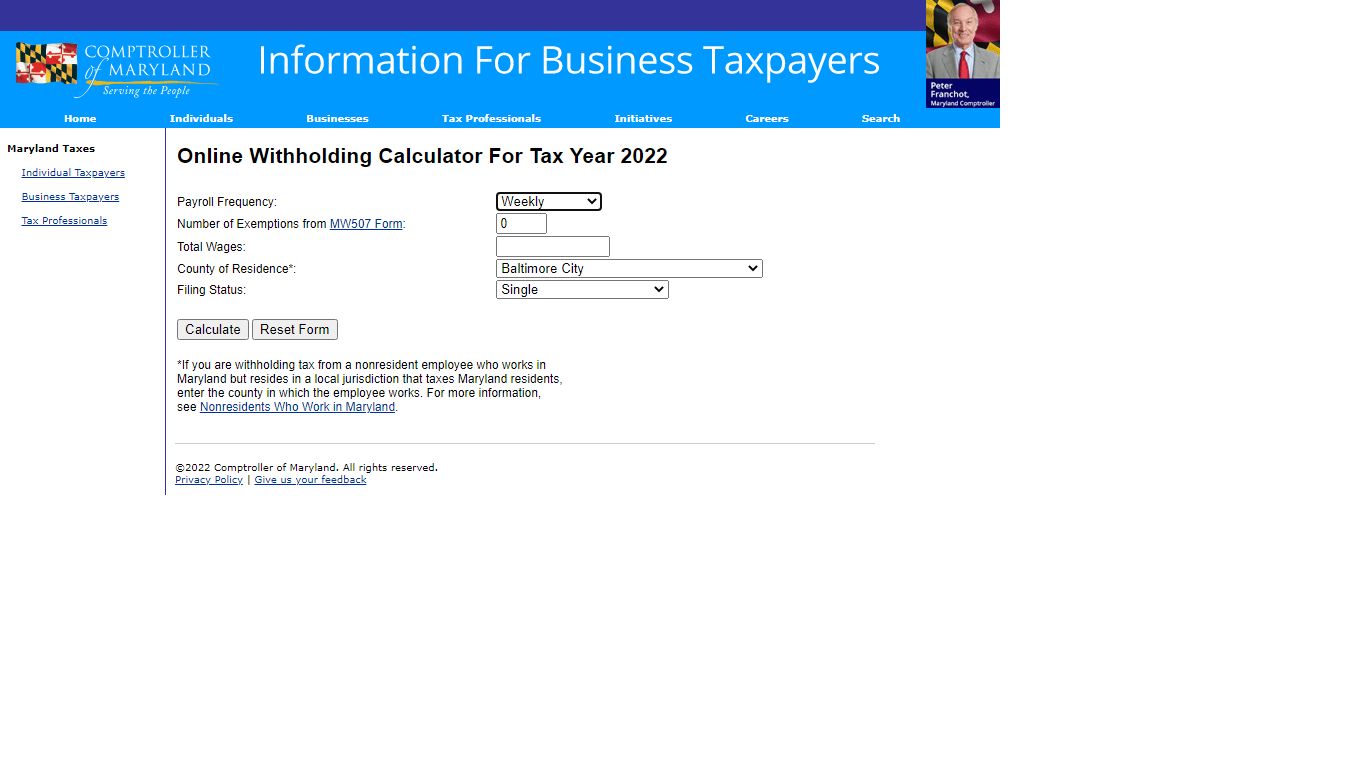

Online Withholding Calculator For Tax Year 2022 - Marylandtaxes.gov

Maryland Taxes Individual Taxpayers Business Taxpayers Tax Professionals: Online Withholding Calculator For Tax Year 2022: Payroll Frequency: Number of Exemptions from MW507 Form: Total Wages: County of Residence*: Filing Status: *If you are withholding tax from a nonresident employee who works in ...

https://interactive.marylandtaxes.gov/business/calculators/WHCalc2022.asp

Marylandtaxes.gov | Welcome to the Office of the Comptroller

The 2022 Sales and Use Tax Exemption Certificate renewal process is now available. Unclaimed Property Holders required to file by October 31, 2022 please see guidance on new regulations. Individual Taxpayers Business Taxpayers Tax Professionals

https://www.marylandtaxes.gov/

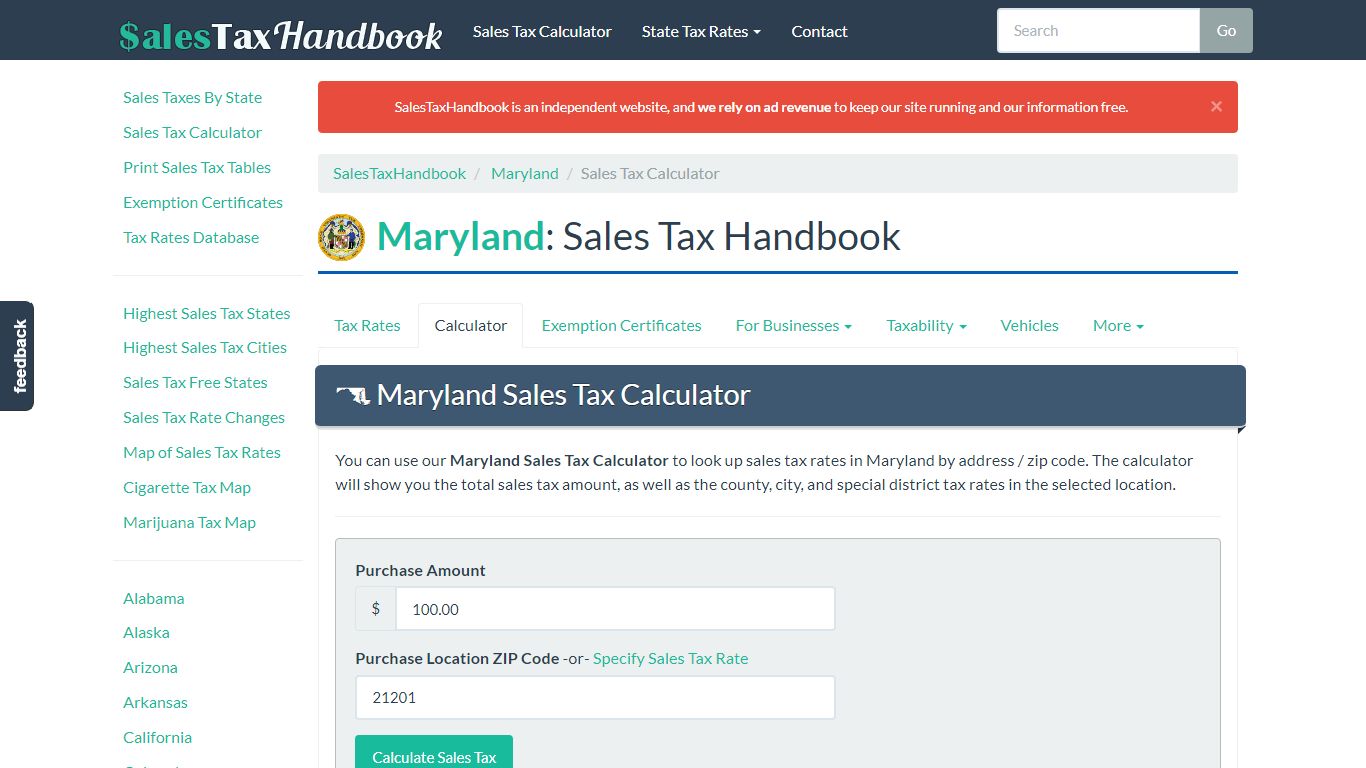

Maryland Sales Tax Calculator - SalesTaxHandbook

The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Maryland has a 6% statewide sales tax rate , and does not allow local governments to collect sales taxes. This means that the applicable sales tax rate is the same no matter where you are in Maryland.

https://www.salestaxhandbook.com/maryland/calculator